Here list of the best entertainment mobile apps that you should try on your device.

If you are finding it hard to manage your money, then the technology can help you to get better control over your expenses so that it matches with your income. To keep your expenses well within what you earn you need the help of a money-saving app to manage your money. To do this, these apps continuously track your spending. Such money-saving apps also come with analytics that allows you to figure out where you are spending more and is there a scope to cut your expenses.

There are numerous money-saving apps available online and it becomes a challenge to find the right one that fulfills your needs. Therefore, we have created a list of 10 money-saving apps that you can look at to find out the one that is perfect for you.

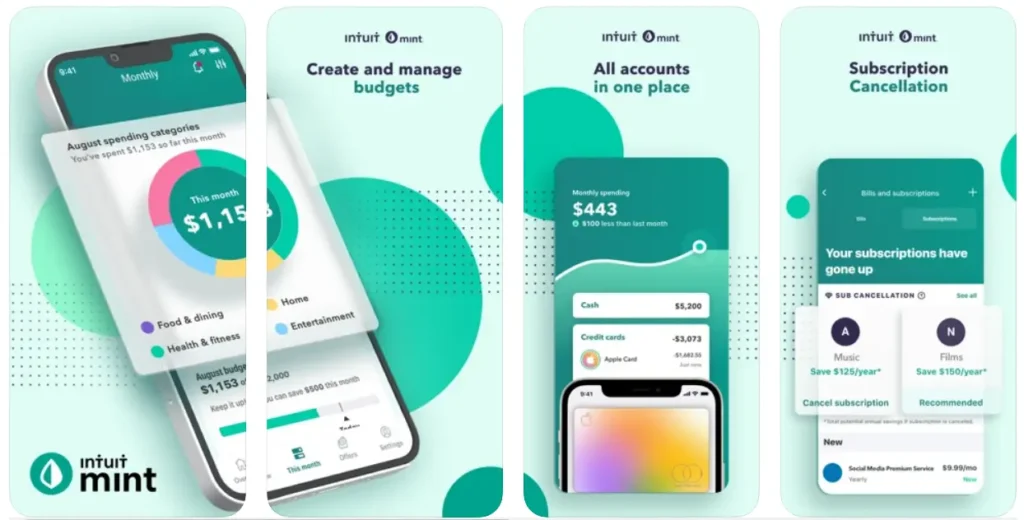

Mint

This amazing app helps you to manage all the financial activities that you do from multiple accounts that include savings, checking, recurring expenses, and so on. Whatever transaction you make, if this app is synced with your bank account, then it would be automatically recorded and then categorize the transactions. The algorithm of this app analyses your spending pattern and then based on it creates a budget. It can also create graphs that would give you a visual representation of your net worth and the cash flow.

Key features of Mint

- Track your transactions to get a complete view of your finances.

- A complete money planning app for account balances, spending, monthly expenses, credit score, and much more.

- Highly secure and is used by more than 24 million users.

- Cancel subscriptions directly from your app.

- In-depth analysis of finances through the MintSights feature.

Acorns

If you are a new investor looking for a tool to manage your money and don’t know much about the technicalities, then this app is perfect for you. To use all the premium features of this app, you have to pay a nominal subscription fee of $ 3 per month. When you sync this app with your bank and credit account, then whenever you swipe your credit card, this app automatically tracks the outflow of money. Based on your swipe pattern it automatically sends an equivalent amount (max $ 5) to your investment portfolio. In this way without your active participation, you will find that slowly but surely your investment is growing.

Key features of the Acorn app

- Automatic investment of money from your account in a diversified ETF portfolio.

- Invest in Bitcoins up to 5% from your savings account.

- A secure retirement by investing in IRA options that include both SEP, Roth, and traditional plans.

- Secure your kid’s features through UTMA and UGMA accounts for kids.

- Bank smarter through the Acorns checking account.

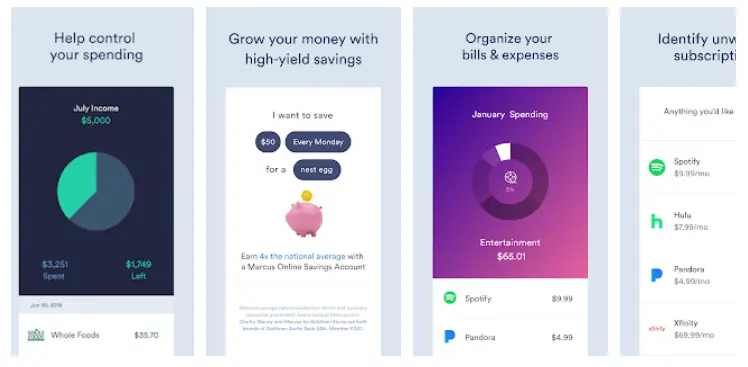

Clarity Money

This is another power-packed saving app that helps you to create a savings account, lower your bills and also cancel any subscription that you have taken earlier. This app comes integrated with machine learning, artificial intelligence, and big data analysis to give you the tools to take control of your expenses. It allows you to find how to lower your expenses, cancel any subscription that you don’t use, and also find those credit cards which offer you better deals. If your expenditure on a specific category is above what you have specified, then it would alert you. Through this app, you would get the right information to make a reduction in your expenses and improve your savings.

Key features of the Clarity money app

- Attractive design that is easy to navigate.

- Easy budgeting as you can see your complete financial inflow and outflow.

- Manage your expenses by analyzing and paying your savings, credit cards, retirement plans, and investment in one place.

- Automatic categorization of transactions for easy understanding.

- Financial analysis with visualization and insightful reports.

Download on Android

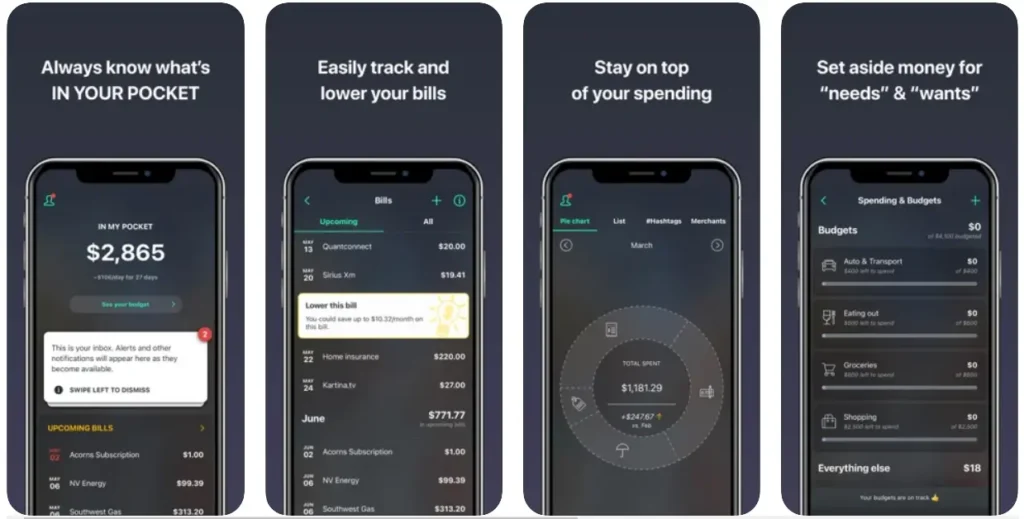

PocketGuard (Bill Organizer: Budget Planner)

The focus of this app is to look at the bottom line i.e., how much you can spend subject to your earnings. You can connect this app to your savings and credit accounts and the app would automatically seek information regarding your transactions and then analyze the numbers to show what you are spending, where you are spending, and how much you are spending. This app allows all your expenses to be categorized under various heads like utility bills, groceries, travel et cetera. You can put a limit on various categories and if you overspend that limit, then it would send an alert.

Key features of the PocketGuard app

- Completely free budgeting app with numerous features.

- Know cash in hand by adjusting expenses from your earnings.

- Sophisticated analytics for better money management.

- Bill tracker and subscription manager to ensure you never miss a due date.

- Goal-oriented helps you to reach your investment goals.

Shopkick

This is one of the top money-saving apps that you will find in the market with over 6 million subscribers. If you use this app and make any purchase, walk into a store or invite some friends to download and install this app then you will earn points. You can redeem these points into any one of the partnering stores into gift cards. This app gives you information regarding amazing deals at big stores so that you can save some money on your purchase.

Key features of the ShopKick app

- Easy and fun to use.

- Earn by walking into a shop of select stores.

- Earn points for every purchase you make in select stores.

- Highly popular as it has millions of users.

- Great discounts on thousands of stores.

YNAB

If you are looking for an app that would allow you to share your spending and any other liabilities with your partner, then this app is perfect for you. This app gives you complete information regarding what you or your partner is spending in real-time through a host of devices. If you are interested in this app, then you have to pay a subscription of $ 6.99 per month or $ 83.99 per year to use it.

Key features of YNAB

- Easy bank sync to get a complete picture of your financial position.

- Real-time expense tracker to get an idea of how to schedule your budget with real-time information.

- Goal tracking helps in ensuring that you meet your financial goals.

- Great analytics that shows your spending progress and helps you to optimize your spending in terms of your earnings.

- Automatic savings that allow you to reach your investment goals.

Digit

The next on this list is Digit, which is a great saving app. It constantly checks the debit and credit balance of your account. It takes some funds from the checking account and puts them into savings. The algorithm decides how much money can be safely taken out of your account to save. If it finds that you don’t have any extra in your account to save, then it will not withdraw any money from your account until you get back to a good credit balance. It is a great app for people who are big-time spenders and want someone to take care of their savings. It offers a one-month free trial and after that, you have to pay $5 per month.

Key features of the Digit app

- Automatic saving for big spenders who want to outsource their saving decisions.

- Seamless investing with a long-term investment account on a balanced portfolio.

- Easy personalization for customized investment solutions.

- Automatic budgeting features budget your bills.

- The card locking security feature allows you to lock your lost debit/credit card.

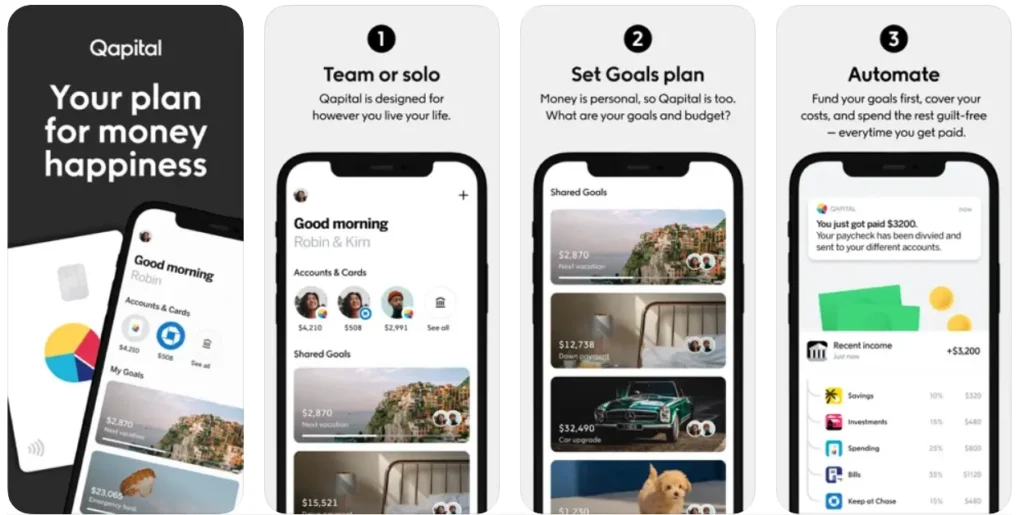

Qapital: Find Money Happiness

This is another great money-saving app that can be customized to automatically save a small amount of money from your account. It can also automatically round up your changes on any purchases you have made and then put that money into your savings. You have the option to make the roundups larger if you have a higher money-saving goal. You can easily link this app to your checking account or you can also sign up for the Qcapital debit card.

Key features of the Qapital app

- Fulfill your long-term investment goal through an ETF portfolio.

- Complete control over your spending with Payday Divvy feature that breaks your monthly income into short-term and long-term investment goals and discretionary spending.

- Develop successful spending habits with this app by adjusting your spending every week.

- Smart investing by selecting the portfolio and letting the app automatically save a small amount of money every month and put it in the investment portfolio.

- Highly trustworthy as more than 2 million people use it to manage their finances.

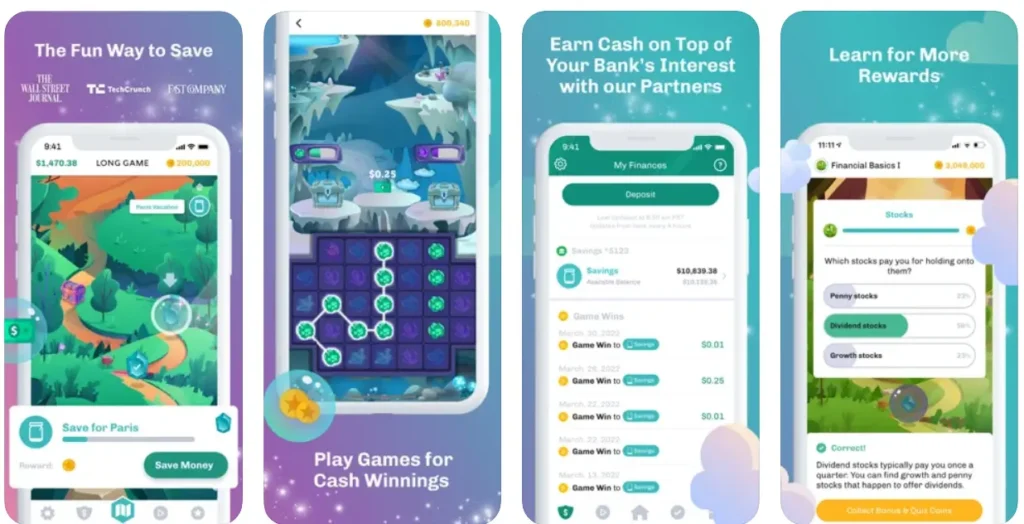

Long Game

This is another money-saving app that you can download and install on your smartphone. It helps you to redirect some of the cash that you may spend on lottery tickets into your savings account. Whenever you put some money into your savings account, this app allows you to win some extra money. The account is fully insured and your principal amount would always remain secure.

Key features of the Long Game app

- Earn some money every day by redirecting some amount to your savings account.

- Play to win cash feature allows you to play inbuilt games to win some money.

- Get personal goals and advice for long-term savings and investment purposes.

- It is safe and secure and millions of people use it to manage their finances.

- Earn money by saving more in your investment or savings account.

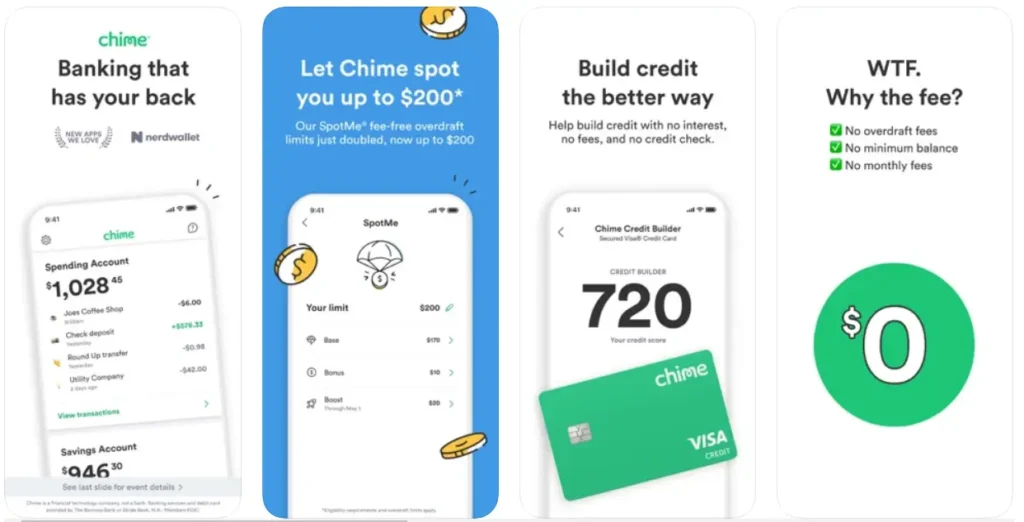

Chime

This is a fantastic money-saving app and millions of customers swear by its features. It offers the users numerous features like auto-saving, easy connection with your bank account, direct deposit to your chime account, and so on. This app allows you to customize how much money you want to save from your monthly paycheck into a savings account. Furthermore, it also has a roundup option that helps in improving your savings further.

Key features of the Chime app

- A highly secure app that requires two-factor authentication TouchID or FaceID.

- Overdraft facility of $ 200 for eligible members.

- Completely free as you don’t have to pay any monthly fee or require any minimum balance also.

- Get paid 2 days early with direct deposit.

- Chime credit builder helps to increase your credit score by 30 points by paying regularly on time.

Conclusion

This is a small but very exclusive list of budget apps that could help you to have more control over your expenses so that you can save some money. Each one of the apps listed here has its own USP and therefore you must carefully analyze their features to figure out which one of these matches perfectly with your requirement.

Comments